remember us in your will

If you have enjoyed spending time in Wells during your lifetime, please consider Homes for Wells when making your will. Homes for Wells has charitable tax status and therefore any gift will be free of Inheritance Tax.

It is important for everyone to make a will – the law that governs what happens to your property if you do not is often surprising. Do not assume that your partner, spouse or children will automatically inherit everything. For more information https://www.gov.uk/inherits-someone-dies-without-will

Many people can’t consider big donations during their lifetime as they are worried about providing for their own old age. A donation on death is often a great way to give something back when you no longer need it yourself.

There are different ways of making a donation:

· Specific gift - some generous benefactors leave us a property. Sometimes a bank account is named or a portfolio of stocks and shares.

· Cash gift – a fixed amount payable from your estate – but do consider that the value of your estate may change – a percentage residuary gift is often a better option.

· Residuary gift – this is where a percentage of your estate (after payment of specific and cash gifts) is left to Homes for Wells. This has the advantage of being appropriate no matter what the size of your estate is on death. Eg if you leave 90% of your estate to family members and 10% to Homes for Wells then the size of the gift will increase of decrease as estate value changes.

Talk to your solicitor when you make your will.

- The gift of a property will enable us to house one more local family for ever and the affordable rent we collect will make a valuable contribution to our cause.

- A gift of £30,000 is often enough to enable us to buy one more home as we can obtain grants and loans for the balance if we have a good deposit.

- A gift of £10,000 may provide better insulation and other essential repairs for one of our older properties to bring it up to standard so we can continue to use it to house a local family.

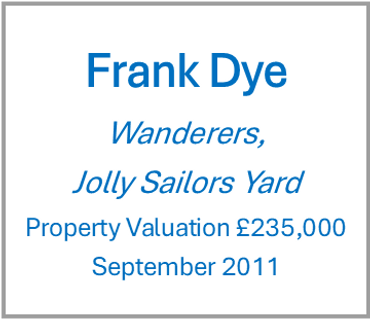

We are extremely grateful to those who have left very generous gifts to Homes for Wells in their wills.

If you would like more information or to discuss anything further please contact Jane, jane.berwick@homesforwells.com